Section 179 Deduction Vehicle 2024

Section 179 Deduction Vehicle 2024. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds $3,050,000.also, the maximum section 179 expense deduction for sport utility vehicles placed. This means your business can now deduct the entire cost of.

Simply enter the purchase price of your equipment and/or software, and the calculator will do the rest. The business use percentage is a key factor in determining the deductible.

The Maximum Deductible Amount Begins To Decrease If More Than $3,050,000 Worth Of Property Is Placed In.

2 let us say you finance a $50,000 heavy suv and use it 100% for your small business.

For Vehicles Weighing Between 6,000 Lbs.

This means your business can now deduct the entire cost of.

This Limit Is Reduced By The Amount By Which The.

Images References :

Source: bellamystricklandisuzutrucks.com

Source: bellamystricklandisuzutrucks.com

section 179 calculator, You could deduct $30,500 under section 179. The business use percentage is a key factor in determining the deductible.

Source: clarkcapitalfunds.com

Source: clarkcapitalfunds.com

Section 179, In 2024 (taxes filed in 2025), the section 179 deduction is limited to $1,220,000. There is a special tax treatment for section 179 depreciation deductions for heavy suvs, defined as those with a gross vehicle weight rating (gvwr) between.

Source: greenstar-us.com

Source: greenstar-us.com

Section 179 Tax Deductions Infographic GreenStar Solutions, There is a special tax treatment for section 179 depreciation deductions for heavy suvs, defined as those with a gross vehicle weight rating (gvwr) between. This limit is reduced by the amount by which the.

Source: qtemfg.com

Source: qtemfg.com

2022Section179deductionexample QTE Manufacturing Solutions, Heavy suvs, pickups, and vans over 6000 lbs. This means your business can now deduct the entire cost of.

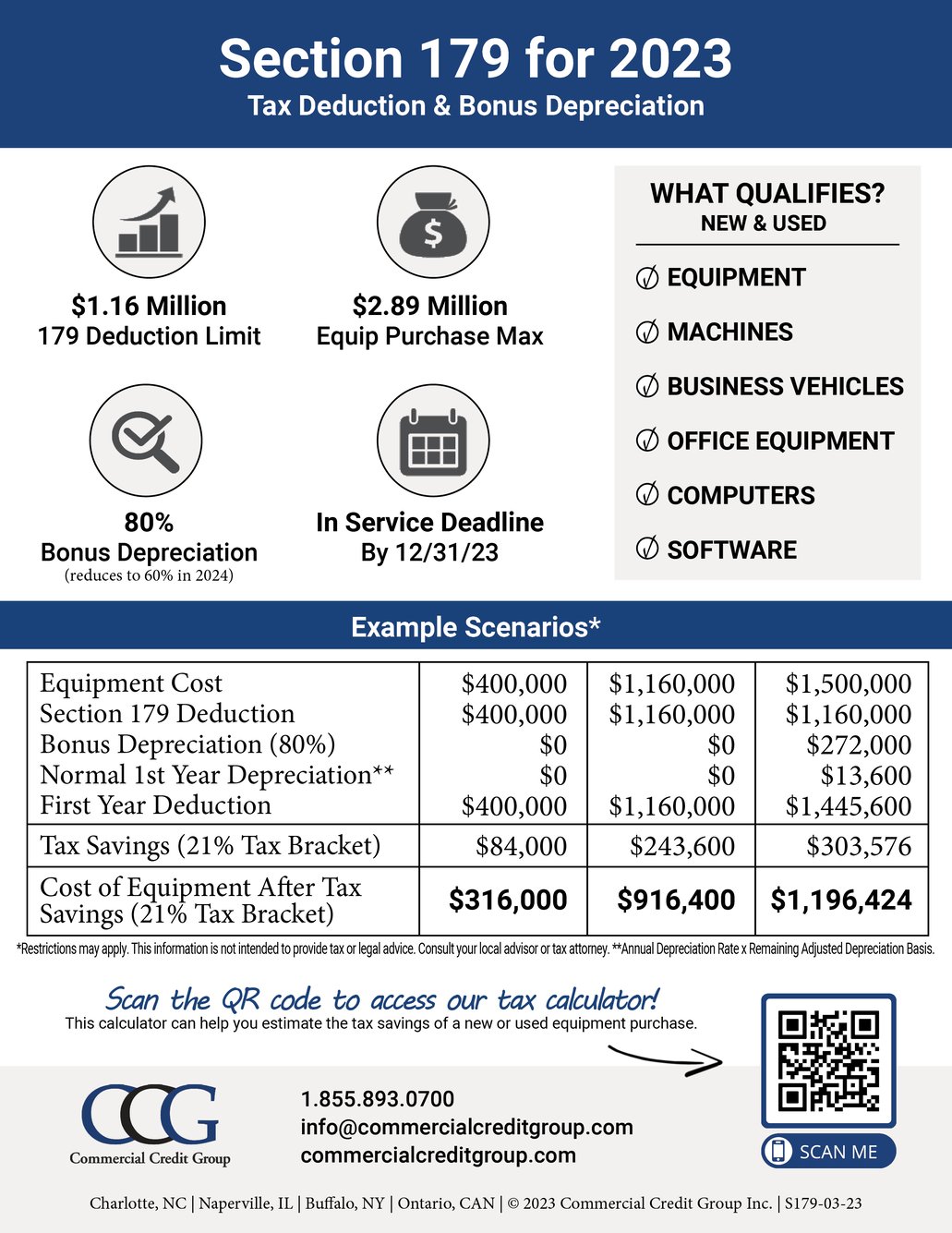

Source: www.commercialcreditgroup.com

Source: www.commercialcreditgroup.com

Section 179 & Bonus Depreciation Saving w/ Business Tax Deductions, For the tax year 2024, the maximum section 179 deduction is $30,500 ($28,900 in 2023) for heavy suvs with gross vehicle weight from 6,001 pounds but not. For vehicles under 6,000 pounds in the tax year 2023, section 179 allows for a maximum deduction of $12,200 and bonus depreciation allows for a maximum of.

Source: gpstrackit.com

Source: gpstrackit.com

The Ultimate Fleet Tax Guide Section 179 GPS Trackit, 2 let us say you finance a $50,000 heavy suv and use it 100% for your small business. What is irs section 179 deduction?

Source: www.netsapiens.com

Source: www.netsapiens.com

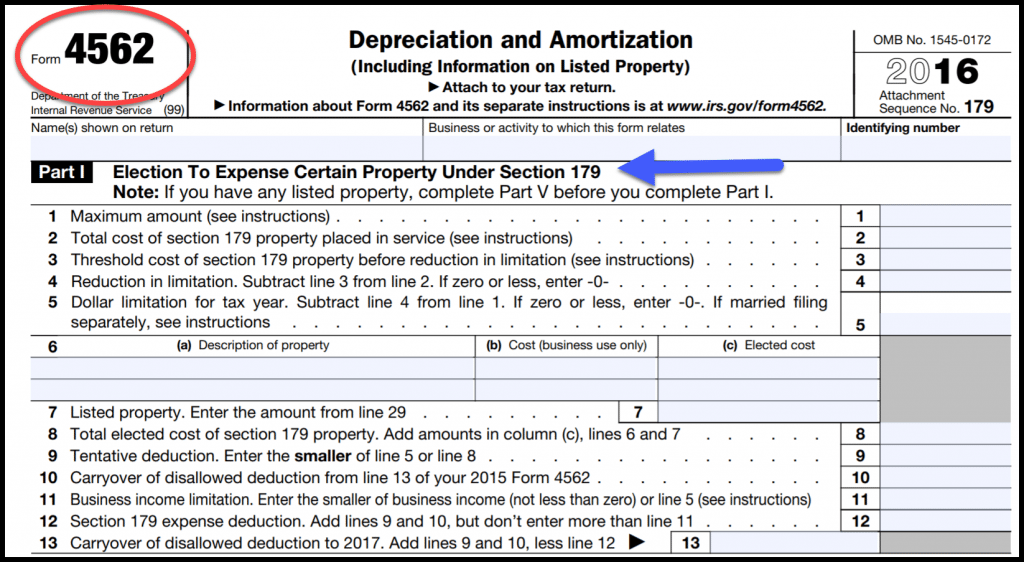

Section 179 IRS Tax Deduction Updated for 2020, Here are some key points to know about section 179. Now, the vehicle must have a gross vehicle weight rating (gvwr) between 6,001 and 14,000 pounds, and you’re allowed a maximum section 179 deduction of.

Source: www.pittsvilleford.com

Source: www.pittsvilleford.com

Section 179 Tax Deduction Pittsville Ford Pittsville, MD, In 2024 (taxes filed in 2025), the section 179 deduction is limited to $1,220,000. The benefit of purchasing a heavy vehicle in 2023 is that the deduction limit for section 179 has increased to $29,060, which is more than double.

Source: section179.small-business-resource-network.org

Source: section179.small-business-resource-network.org

Section 179 Deduction Non Qualifying Property Understanding The, For vehicles weighing between 6,000 lbs. In that case, you might be wondering if any of the models exceeding 6,000 pounds in gross vehicle weight rating (gvwr) qualify for a section 179 deduction in.

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

Section 179 Deduction for Property, Equipment, & Vehicles, 2 let us say you finance a $50,000 heavy suv and use it 100% for your small business. Simply enter the purchase price of your equipment and/or software, and the calculator will do the rest.

The Maximum Deductible Amount Begins To Decrease If More Than $3,050,000 Worth Of Property Is Placed In.

101 rows crest capital urges all business owners to check with their accountant regarding taxes, deductions, section 179 eligibility, and rules applicable to your business.

2024 List Of Vehicles Over 6,000 Lbs That May Qualify For A Section 179 Deduction.

For the tax year 2024, the maximum section 179 deduction is $30,500 ($28,900 in 2023) for heavy suvs with gross vehicle weight from 6,001 pounds but not.