Massachusetts Capital Gains Tax 2025

Massachusetts Capital Gains Tax 2025. On october 4, 2023, massachusetts governor maura healey signed into law bill h.4104, which provides $1 billion in tax cuts creating savings for businesses, renters,. What is the 4% surtax?

Capital gain taxation in budget 2024: When shares are sold one year after purchase, the gains earned amounting to ₹1 lakh and above are taxed as per the provision of long term capital gains.

Starting With Tax Year 2023, Personal Income Taxpayers Must Pay An Additional 4% (4% Surtax) On Taxable Income Over $1,000,000,.

To learn more, click here.

A Review And Possible Simplification Of The Capital.

In 2024, single filers making less than $47,026 in taxable income, joint filers making less than $94,051, and heads of households making.

Massachusetts Capital Gains Tax 2025 Images References :

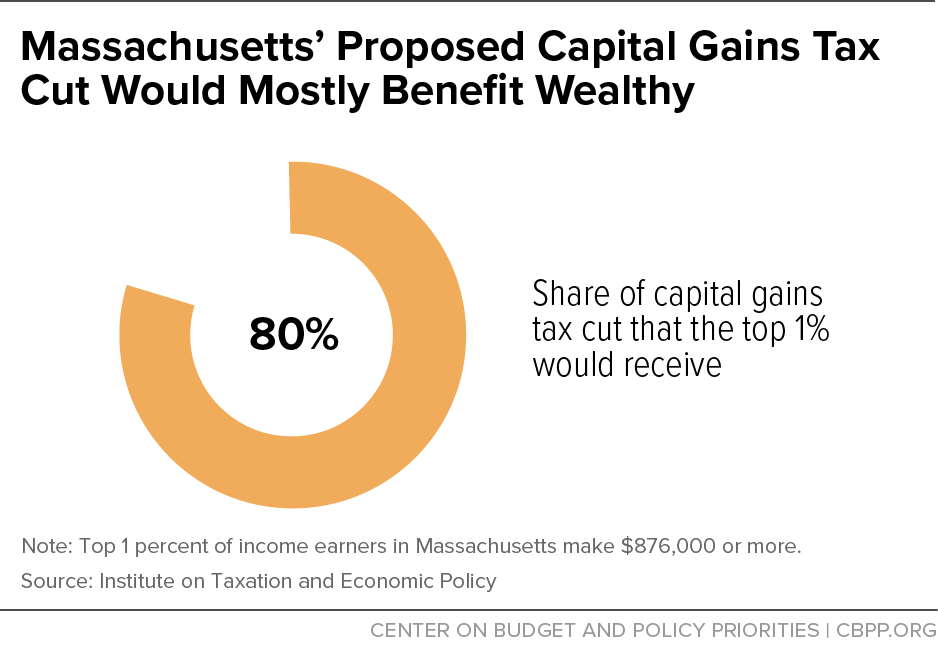

Source: www.cbpp.org

Source: www.cbpp.org

Massachusetts’ Proposed Capital Gains Tax Cut Would Mostly Benefit, On october 4, 2023, massachusetts governor maura healey signed into law bill h.4104, which provides $1 billion in tax cuts creating savings for businesses, renters,. Industry and investors have been seeking a simplification of the regime.

Source: prorfety.blogspot.com

Source: prorfety.blogspot.com

Does Massachusetts Have Capital Gains Tax PRORFETY, Industry and investors have been seeking a simplification of the regime. With the addition of the 3.8% net investment income tax (niit) designed to fund the affordable care act, and the additional medicare tax, the total capital gains rate could.

Source: burnsandwebber.designbyparent.co.uk

Source: burnsandwebber.designbyparent.co.uk

How Capital Gains Tax Changes Will Hit Investors In The Pocket Burns, Capital gains in massachusetts are taxed at one of two rates. That tax rate is over twice the state’s individual income tax rate of 5% and, when including the.

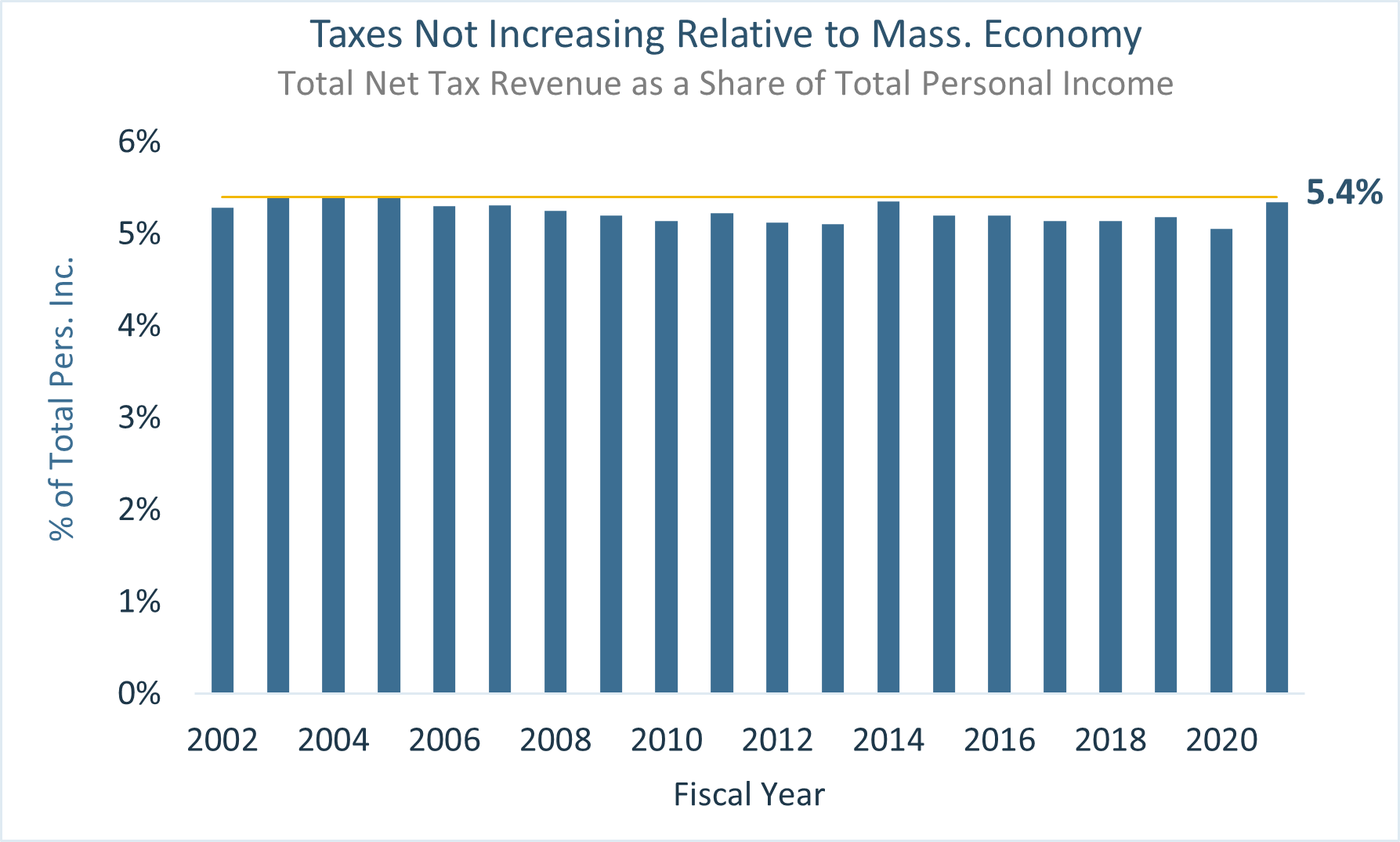

Source: massbudget.org

Source: massbudget.org

“Excess” as Mirage How the 62F Tax Cap Distorts Our View of, Capital gains tax rate 2024. Long term capital gains from dividends, interest, wages, and other income:

Source: howmuch.net

Source: howmuch.net

Mapped Biden’s Capital Gain Tax Increase Proposal by State, On october 4, 2023, massachusetts governor maura healey signed into law bill h.4104, which provides $1 billion in tax cuts creating savings for businesses, renters,. Long term capital gains from dividends, interest, wages, and other income:

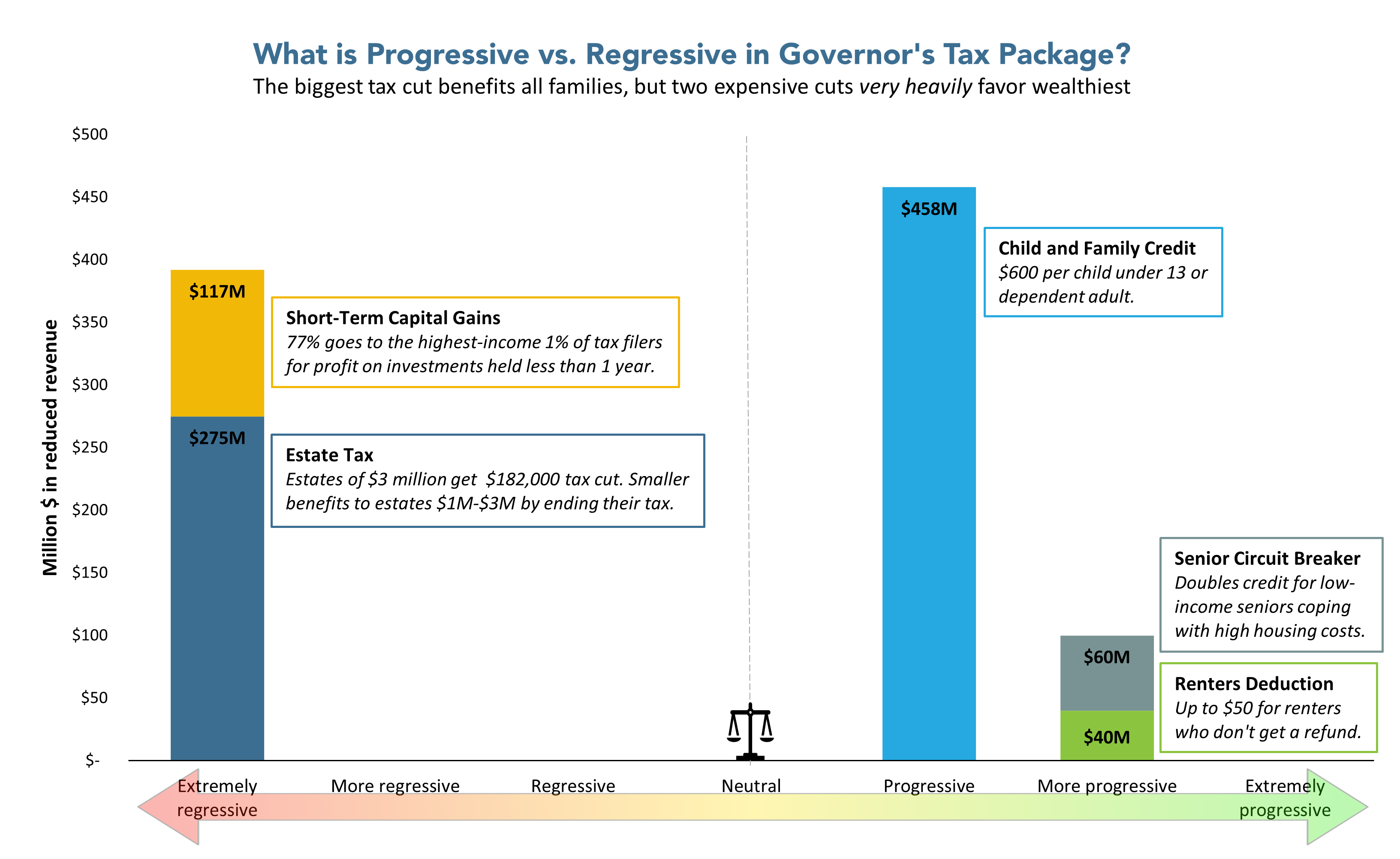

Source: massbudget.org

Source: massbudget.org

Taking Measure of the Governor’s Tax Plan Mass. Budget and Policy Center, Starting with tax year 2023, personal income taxpayers must pay an additional 4% (4% surtax) on taxable income over $1,000,000,. Income tax rate parity, uniform holding period for.

Source: www.youtube.com

Source: www.youtube.com

Chapter 11, Part 3 Tax Forms for Capital Gains & Losses YouTube, What is the 4% surtax? Starting with tax year 2023, personal income taxpayers must pay an additional 4% (4% surtax) on taxable income over $1,000,000,.

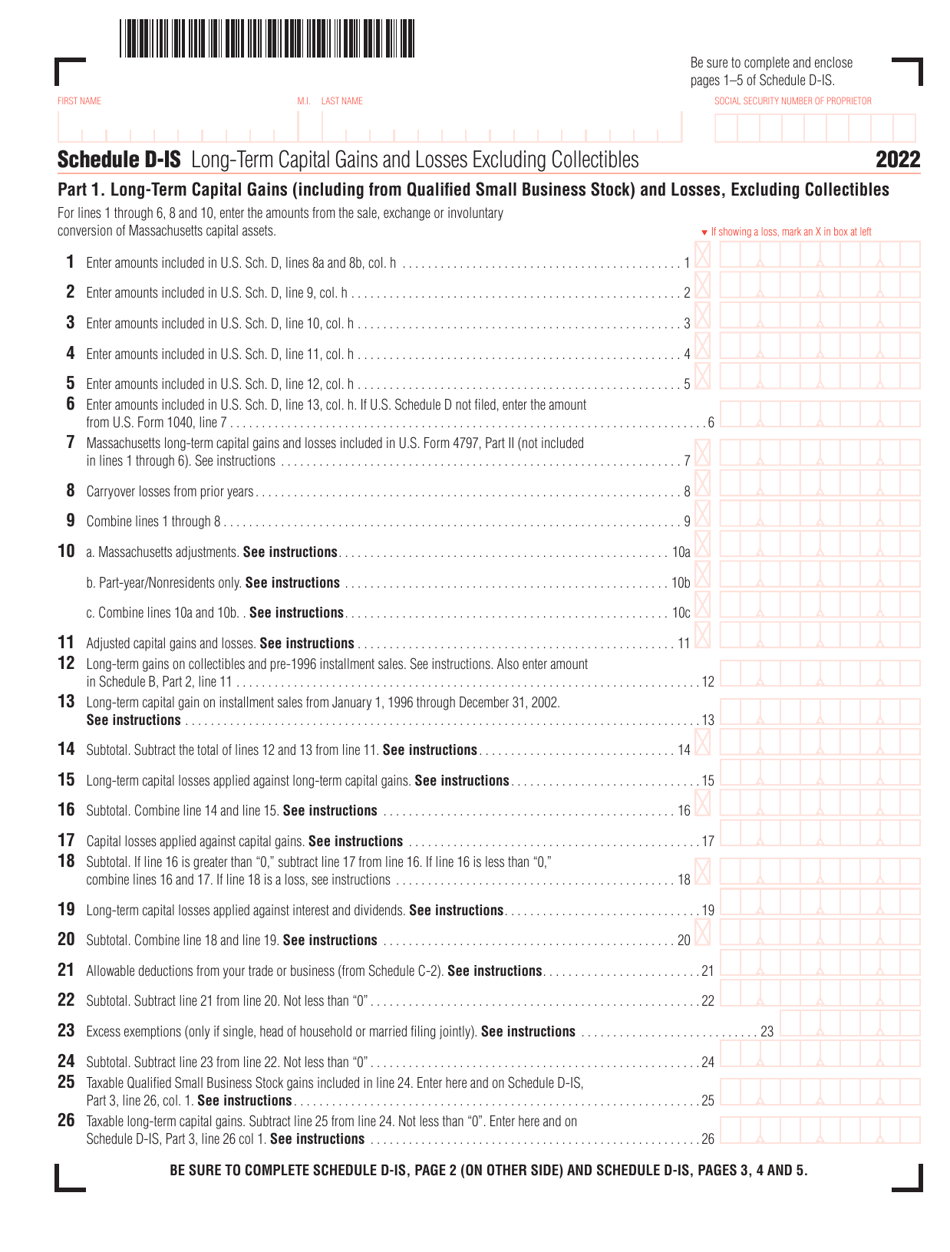

Source: www.templateroller.com

Source: www.templateroller.com

2022 Massachusetts LongTerm Capital Gains and Losses Excluding, A review and possible simplification of the capital. Capital gain taxation in budget 2024:

Source: taxtherichny.com

Source: taxtherichny.com

Why Tax the Rich? Tax the Rich, Effective for taxable years beginning on or after january 1, 2002, the new capital gains tax law establishes a limit of $2,000 for the deduction of net capital losses against part a. Industry and investors have been seeking a simplification of the regime.

Source: ourmartech.com

Source: ourmartech.com

NOUNS Capital Gains Tax OurMartech, By understanding and considering these rules, you can save on massachusetts capital gains taxes and avoid a number of possibly expensive mistakes. Updated jul 03, 2024, 2:55 pm ist.

To Learn More, Click Here.

How would the capital gains tax change under biden’s fy 2025 budget proposal?

Industry And Investors Have Been Seeking A Simplification Of The Regime.

Capital gain taxation in budget 2024:

Category: 2025